Market Intelligence

The Visitor

2022 Visitor Survey Results

Visit County Durham has been tracking the visitor profile for the county since 2007. 1200 face to face interviews were conducted at numerous locations throughout the County for the 2022 study. The research examines all aspects of the visitor journey to understand what motivates, satisfies and disappoints our visitors. Previous visitor surveys were conducted every 3 years between 2007 and 2019.

- Visitors were mostly from the North East region (39%) however 14% were from Yorkshire and 11% from the North West. 4% of visitors were from overseas.

- 46% were on an overnight visit

- 47% were visiting with their partner only and 35% were visiting with family members

- 86% arrived to the destination via car

- On average day visitors spent 4hours 22 minutes in the destination.

- Over a quarter (27%) had planned/were staying in self-catering accommodation

- 31% researched their stay via the internet and 16% via review sites such as TripAdvisor.

- 34% booked via an internet site and 25% booked directly with the accommodation via telephone.

- Half of respondents booked between 1 and 3 months ahead of their visit

- On average visitors planned to stay for 5 nights away from home

- 58% of respondents found out about Durham prior to their visit from friends or family and 46% from a previous visit.

- When asked about their main activity during their visit, 40% stated general sightseeing, 14% visiting historic or artistic exhibits, 9% visiting heritage sites and 8% walking.

- When asked what they liked most about Durham, respondents stated the peaceful nature, the variety of things to do, friendly people and value for the whole family were key attributes.

- 96% would visit again.

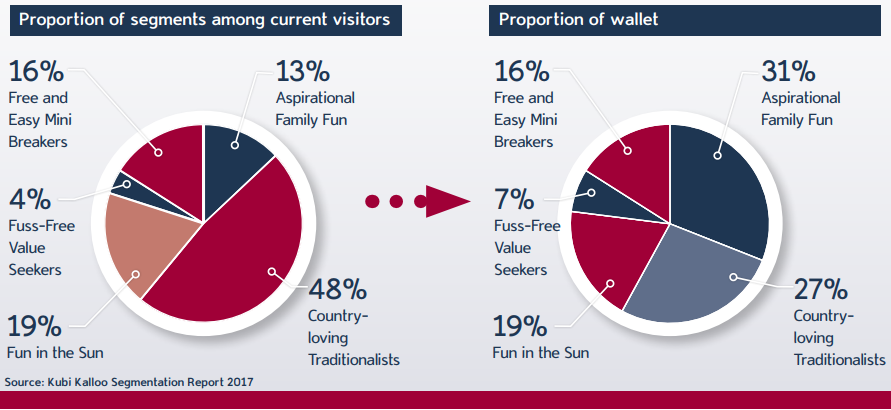

Segmentation – visitor target groups

3 key markets for Durham

1. Country-loving Traditionalists – “Empty-nesters seeking a traditional rural break. Love unspoilt countryside, walking and visiting heritage attractions – and sampling local food and produce”. Moderate spenders but current high volume.

2. Fun In The Sun – “Beach-loving families with kids in tow. Travel in-season and prefer outdoor activities”. Low spenders but moderate current volume.

3. Aspirational Family Fun – “High-income and often London-based families who can afford to try a wide range of activities – and take more holidays than the other segments”. High spenders and moderate current volume.